Tagged: buy gold

Silver And Gold – Is Now The Time To Buy?

The question has never really been “Kong – should I buy gold?” but more so “Kong – WHEN should I buy gold?”

The long-term fundamental case for owning gold and silver is as solid today, as it will be tomorrow – and as it’s always been. You can’t go wrong owning silver and gold “if” – you’ve got a long enough profit horizon.

Up until now, gold and silver haven’t been a “trade” as the metals have “generally” fallen like mad, and sat consolidating in range for what feels like eternity. Silver is just a touch lower than the price a full 6 months ago. For the most part when any asset consolidates for this kind of “extended period” the move “out of this consolidation” is usually quite powerful. Very powerful.

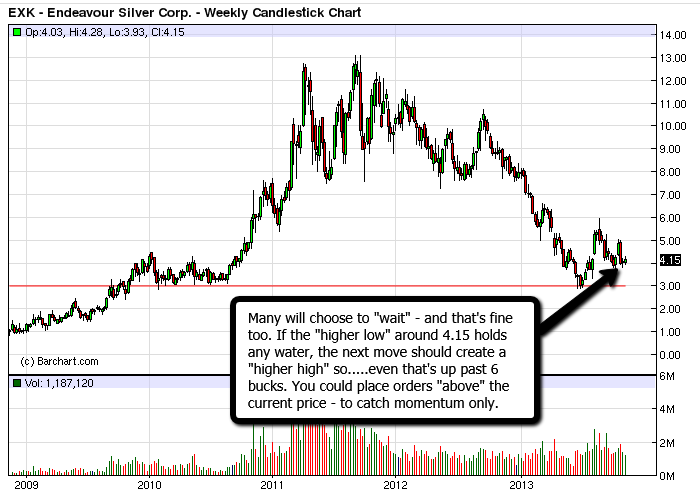

In fact, in this case it’s very likely that the first move upward in both gold and silver will be so fast, and likely so large – that anyone who “wasn’t already in the trade” will be left chasing. Not to say that “you’ll miss the boat” as the PM’s (precious metals) have miles of upward potential – just that…..you may be looking to buy “EXK” for example at 7 dollars – as opposed to getting started, down here around 4 bucks.

We are very close to where I would suggest “starting to build positions”, and I feel that the “miners” will provide the largest “bang for your buck”.

It doesn’t matter which “silver miner” you look at as…the charts all look more or less exactly the same. I like EXK as a “trading vehicle” to make a play in the space – but a pile of others will also move in tandem when the PM’s move.

Check out “GPL” for a super low value play – currently trading at .76 cents!

Gold Priced In USD – Invest Don’t Trade

It remains to be seen as to what kind of “legs” this USD rally may have, and it’s implications with respect to the price of gold.

We’ve been over the “theory” as to why the Fed would prefer a lower price in gold as the US Dollar devaluation continues, but of course that’s all it’s been – theory. I fully understand the “short selling” in the paper market by Ben’s friends on the street, but to consider some kind of “global conspiracy” to keep the price “in line” with a sliding US Dollar would be a stretch for sure.

Looking at recent price movement we are “once again” in a position where both the U.S Dollar as well as gold have been falling together ( more or less ) where as just today, a decent “inverse” move with the dollar up and gold down another 17 bucks.

The analogy of “turning around a big cruise ship” as opposed to a motor boat comes to mind in that….these things play out day-to-day but are really moving on a much larger scale over a much longer period of time – and it does take time to turn that ship around. More time than most traders can bear.

It’s my view that anyone “building positions” in the precious metals around this area of price and time ( and lower ) shouldn’t really get into “to much trouble” looking longer term. It’s certainly not a trade, and it’s a big, big boat to turn so….weather or not you can take/manage the drawdown and slug it out is always a matter of ones personal trading / account / exposure / leverage etc…

Looking at specific “price levels” in an attempt to “nail it” on an asset worth 1300.00 bucks is a fools game, as fluxuation’s of 50 bucks here and there would apear normal ( % wise ) when trading “anything” of lesser value.

Hang in there is about all you can do.

Gold And Silver – Manipulation Explained

If you’re having trouble accepting the general idea that the U.S Federal Reserve will continue its assault on the U.S Dollar ( devaluing USD providing considerable relief to the current government debt obligations) then I can’t imagine you’ll be particularly thrilled with the following breakdown on gold and silver.

There is no greater enemy to the Fed than a rising price in gold or silver.

Against a backdrop of such extreme money printing and currency devaluation in the U.S, if left to reflect its true value” (as we’ve seen with respect to the price of gold priced in Yen) the price of gold would now be significantly higher – and I mean SIGNIFICANTLY HIGHER than we see reflected in the current “paper market”.

When ever Uncle Ben gets nervous about the price creeping higher, he simply calls his buddies at JP Morgan, sends them a couple suitcases of freshly printed U.S toilet paper and POOF!

JP Morgan piles in even further “short” (via naked short contracts placed at the CME / COMEX) and the “paper price” continues to flounder/move lower. Ben keeps printing useless fiat paper – and the continued “illusion of prosperity” runs across televisions country-wide.

As I understand it ( and please forgive me if I’m way off ) there is considerably more silver/gold current sold “short” than physical / actual metal currently “above ground” on the entire planet Earth, and as informed investors now look to take “actual delivery” of the physical as opposed to just “trading in the paper market” we are about to see some serious fireworks.

Many heavy hitters have already suggested that The Comex may soon be looking at default. (CME Group is the largest futures exchange in the world. Many commodities, of which gold is one, are traded on this exchange. The gold exchange – which is often still referred to as the Comex, its original name prior to being bought by the CME – is the largest gold exchange by volume in the world).

Take it for what it’s worth as JP Morgan is now under investigation by the FBI and other authorities – this all may fall into the category of “conspiracy theory” if one chooses to just bury their head in the sand.

Your head would absolutely spin if we jump up another “rung on the ladder” to discuss the London Bullion Markets, The Bank of International Settlements and The Fractional Gold System – let alone where China fits in.

Gold And The Dollar – What’s Next?

If you consider the massive easing / devaluation of the Japanese Yen some months ago, and put yourself in the shoes of an average Japanese investor waking up, morning after morning – only to see the price of Gold (priced in Yen of course ) going through the roof, you’d almost think you’d entered the Twilight Zone.

This doesn’t make any sense! I thought the price of Gold was going down, down down. What gives?

When traded “against” a currency that is rapidly losing it’s value ( via rapid printing / easing such as the methods currently being used by the U.S Fed) , it only makes sense that a hard asset ( such as Gold) which cannot be duplicated/printed/ reproduced “should” rise in value substantially – as in the simplest sense – you’ll need a whole lot more of that “local currency” in order to purchase it right?

The example seen in Japan is exactly what one would expect to see – when a currency is rapidly debased in value, and then compared / traded against something that “cannot” be artificially created. Currency value down = Gold price up.

So what the hell has been going on in the U.S then? Why do I see the value of Gold taken to the cleaners AS WELL my USD / purchasing power getting smashed? How can this be?

How can this be you ask? How can this be?

………………………to be continued.

Should I Buy Gold Kong?

I get this question a lot – a whole lot. Should I buy gold? Is gold going back up?

Interestingly, if you zoom out to a much longer time frame chart (maybe a weekly and even a monthly chart) you’ll see that Gold has suffered recently – yes…..but is “still” in an uptrend (pending it slows down and looks to reverse in and around this area sometime soon).

I would have to consider 1155.00 as a level of considerable importance and significance.

But please keep in mind (as we’ve discussed with respect to long-term charts) that turns on a weekly chart can take “literally” weeks, and weeks to stop then consolidate and finally turn to reverse course. Even at that ( considering we are looking at an asset that costs 1190.oo dollars) a hundred dollars here, a hundred dollars there – these aren’t “large swings” percentage wise. Putting an exact number on it is a fools game.

More important than the question of “should I buy gold?” would be the matter of “how do I buy gold?”

Don’t charge in there looking to call it a “trade” as you’ll likely miss on nailing an entry, but rather “build” a position over time “smoothing out” this volatility and not sweating the 50 buck swings.

Patience is your greatest asset here. You really can’t rush this one.

Possible Hope For Gold

It’s been some long and grueling months for gold traders, and those watching PM’s and the miners in general. Week after week of potential bottoms or reversals – only to be followed by selling, selling and more selling. The price of both silver and gold in the “paper markets” passed the point of “rational” some months ago with seemingly no end in sight – a real tough spot for those holding strong…for sure.

We touched on this some weeks ago in that the problem with todays “investing environment” is that it “isn’t rational” – not in the slightest bit! With the amount of global stimulus being pumped into markets / Central Bank intervention etc – this isn’t in any way the market that most of you may be accustomed to investing in. Looking for similar results as one has experienced in the past has likely been recipe for disaster.

The fundamental reasons for owning gold have not changed, and likely grow stronger by the day as “paper money” planet wide is printed like toilet paper with hopes of keeping the ship sailing in the right direction just a little while longer.

How do you keep your sanity as a trader of Gold?

I would advise dropping your expectations. As simple as that.

I find it pretty unlikely that anyone is going to “time the trade” and make some massive “get rich quick” type thing any time soon with the purchase of Gold – however…..if one can lower their short-term expectations and try not to “treat it like a trade” – there’s plenty to made…….. if you can remain patient.

With the US dollar moving considerably lower over the next few months – this may be a decent time to start building positions – but in all…..we could just as easily see Gold consolidate here for months, and months on end. One needs to realize the Fed’s agenda and how a blatant rise in the price of Gold seriously undermines the goal of crushing USD – so as long as Ben’s got his finger on the printing presses – It’s hard to imagine gold getting too too far out of the gates.

Goldbugs – You Just Don’t Get It

I’m going to try and go easy – as I know many of the readers here are very much so invested in Gold. As well please keep in mind – I too believe in the long term story.

But with such macro forces at work – it absolutely pains me to envision you sitting there at home, considering every little tick up and down, gaps, bollinger bands, cycles, COT, and the most ridiculous of all – “selling on strength and buying on weakness numbers” – on “paper gold” through GLD!

It’s Ridiculous! Stop it! Stop it right now!

I’ve even heard some of you consider that Uncle Ben’s 85 billion dollars a month could in some way be “good” for gold prices?? Have you lost your mind? Seriously! It’s 100% completely the opposite!

Ask yourself this: Who on earth could believe the dollar’s exchange rate in relation to other currencies if the dollar was seen collapsing in value in relation to gold and silver?

This would completely defeat the money printing effort of the Fed – and completely undermine the bond buying!

The Fed is a private bank! with one goal and one goal only – to profit! They can’t possibly let the value of gold skyrocket if they intend to kill the U.S dollar! Think about it!

So……The Federal Reserve uses its dependent “wallstreet bank buddies” to short the precious metals markets. By selling naked shorts in the paper bullion market against the rising demand for physical possession, the Federal Reserve is then able to drive the price of gold down.

Bullion prices take a big hit, bullishness subsides and the flow of dollars into bullion is stopped….and the money printing can continue.

As long as the Fed continues to print ( and soon looks to print more ) I am at odds with any suggestion that gold will do anything more than trade flat at best.

In any case – bring it on then……I’m ready.

Gold Trade – For The Last Time

I suggested some months ago to buy gold and gold related stocks. Since then the price of gold, and performance of the related miners has gone nowhere but down…and down….and then down even more.

I lost $1500.00 bucks in options that expire today – likely the largest “losing trade” I’ve made in many months.

Putting this in perspective – I see $1500.00 (+/-) flash on my screens a few times a week (if not daily) as it represents “peanuts” in the grand scheme of things. I spent about a week watching the trade go against me before I put it aside in the “whatever” category and got on with my work – banking some of the best returns of my life over the same period of time via the currency trading.

The plain fact of the matter is… regardless of price – in the current “print til you can’t print anymore” environment – there is absolutely no reason to own gold. There is no fear. There is no “need to store value” while stocks are blasting to the moon! People (including myself) are making money hand over fist in a number of areas as gold bugs continue to debate/rationalize/haggle the reasons as to why their “all in bets” on the shiny metal haven’t made them rich – but more so bust their accounts.

Its foolish investing. It’s gambling. It’s naive and its completely irresponsible.

Bottom line – gold will make it’s move when stocks and “risk” tanks. And from what I gather – the FED is gonna work pretty damn hard to make sure that doesn’t happen……. anytime soon.

I do plan to “re enter” and take another shot at gold and related names – but as seen a week ago when gold popped some 30 bucks on the big DOW DOWN DAY – it looks pretty obvious to me that we won’t see a move in gold – until we see some serious fear enter the market – regardless of where the USD is at.

SDR’s First – Then The Gold Standard

Special Drawing Rights (SDR’s)

The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries official reserves.

Its value is based on a basket of four key international currencies, and SDRs can be exchanged for freely usable currencies. With a general SDR allocation that took effect on August 28 and a special allocation on September 9, 2009, the amount of SDRs increased from SDR 21.4 billion to around SDR 204 billion (equivalent to about $310 billion, converted using the rate of August 20,2012).

So in other words – the U.S has a printing press, the ECB has a printing press, Japan’s of course, Great Britain’s got one and the freakin International Monetary Fund ( operated primarily by a small group of “financial elite) can rattle off “SDR’s” and distribute them (as freely tradeable currency) to its members – at will.

This will clearly be the next step in resolving the current global financial crisis as the printing continues.

With everyone devaluing their currencies at the same time ( and Central Banks suppressing the value of gold as a price spike would undermine the entire plan) it’s very likely that the next “crisis” event will simply be “papered over” with the issuance of “SDR’s” and the “can kicking” will continue down the “global road”.

Anyone expecting some “massive rise in the price of gold” overnight – is likely in for a longer wait in that……the “paper game” has miles to go before your “$7000 oz” will be realized. As well – if you live in the U.S, I’d look forward to any large profits being made subject to a “newly formed gold tax” – likely in the neighborhood of 80%.

Have you considered that “the power’s that be” already have this worked out?

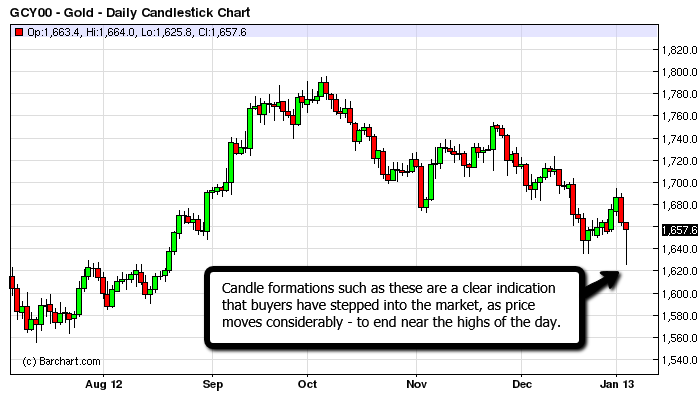

A Golden Hammer – Has Gold Bottomed?

Hammer: Hammer candlesticks form when a security moves significantly lower after the open, but rallies to close well above the intraday low. The resulting candlestick looks like a square lollipop with a long stick. If this candlestick forms during a decline, then it is called a Hammer.

I’ll be the last one to call it as I am relatively new to the world of gold – but can tell you it’s been a complete and total grind for the past few months. This particular candlestick formation is usually a pretty good sign that buying interest has started to creep back in. Usually a trader will wait for an additional days candle to form (ideally closing above the high of the hammer) before entry.

If it provides any relief going into the weekend – I for one have considerable confidence that we should see some higher prices moving forward.