Tagged: trading eur/usd

Daily Forex Strategy – May 21, 2015

This is a quick look at where I’m looking for my next trade entry.

This scenario suggests that USD has not yet found its intermediate term low, and that we’ll see another substantial leg down “first”.

On the flip-side USD breaks upward, breaking though the 50 SMA ( now clearly pointing lower ) and heads for the highs..only to stall out there and spend “eternity” flopping around at similar levels.

You’ll have to appreciate that all the fuss about Eur/Usd is just more “retail propaganda” manufactured by the financial / foreign exchange industry to have you trading the pair “thinking” you’ve got an edge or an advantage. These are the planets two most widely held “reserve currencies” and will always “flip and flop” based on simple market mechanics.

Pull a monthly chart of EUR/USD and realize the pair can trade in as wide a range as .40 cents! Without a single “meaningful repercussion” to either economy. There is no “fundamental reasons” to track the pair…..and I rarely trade it.

Retail flock to it….as the media would have you. Silly.

If USD turns “on cue” you’ll have to expect U.S Equities to do the same…. but then again….I’ve been saying that for a looooooong time now.

The “range grind” continues.

Upside Targets Met – Thoughts On Jackson Hole

Well that has my upside targets in both The Nikkei (15,499 ) as well SP 500 ( 1668 – 1678 ) more or less met so…….

Give or take another couple of points over the next day or so, this certainly creates an interesting scenario moving towards Jackson Hole – and the expected “chatter” out of The Fed.

It’s been my believe that “this indeed will be the time” where markets are given “some kind of clue” that perhaps the time has come to buckle up / take profits / begin taking precautions as to coming changes in monetary policy etc but…..I’ve obviously been disappointed by Yellen in the past.

Lining up the fundamentals as well technicals would have both USD as well as Equities take a turn lower, with JPY ( as well gold ) moving higher ( and obviously the commodity currencies falling off along side risk ) so…..the question obviously begs……

Will The Fed do it or not?

One has to keep in mind that, as much as a strong USD ( in at least one way ) creates an impression of a stronger economy, it also represents a tremendous burden on the American Governments debt load. For every single point that USD moves higher…..the amount of outstanding Government debt also moves higher – having to be repaid in USD.

It’s been The Fed’s plan since all of this began to “keep a cap on USD” ( well actually to drive it into the basement ) with the thought in mind of “exporting inflation” and keeping the “service of outstanding debt” at a bearable level.

One has to keep in mind that The American Government and The Fed NEED a weaker dollar in order to keep the ponzi going so…..it’s difficult to imagine USD “shooting for the moon” before at least another solid move lower, as changes to monetary policy ( and the supposed “end of QE” ) take root here in October.

Trading it is a nightmare as…….one stands to take a substantial hit getting caught leaning to hard in either direction – with these types of “risk events” best viewed from the sidelines.

As it stands I will continue to hold the few “short USD” irons currently in the fire, and let the chips fall where they may, with continued focus on JPY vs the commodity currencies setting up for the larger trade at hand “post Fed”.

Continued divergence across several currency pairs still see USD moving lower….before higher.

Long EUR/USD at 1.34 – Low Risk Entry

Likely a pretty slow / sleepy to start to the week considering the slow summer months so…

Long EUR/USD still looks like the most reasonable play here for a bounce in risk / move lower in USD.

The JPY pairs are behaving “exactly as expected here” so for those interested in taking a shot ya…..just look to get your stops below those “prior near term lows” and let it be what it will be.

Commod currencies ( AUD / NZD and CAD ) would usually bounce along side risk as well but from what I can see / consider here these past days – they aren’t looking to make any major moves.

With AUD now “finally” showing its hand I think it’s safe to say these currencies have already began the larger “longer term move” in selling off / making the turn.

Sure we can expect a bounce but I really don’t think they’ll get to far.

We’ve identified that AUD has now rolled over on has high a time frame as the 4H – taking months to do so.

This kind of thing is not just “quickly reversed” so again……please consider any further “upside” in AUD to be “counter trend” and trade it accordingly.

I’m adding a couple contracts long EUR/USD here today, and will trade it actively should we see some volume and a solid move.

The benefit of staggering small orders over time should be noted here….as EUR/USD still sits around 1.34 – now going on a full week.

There is “no benefit” in jumping into a trade with your full position / max commitment during times like these, as you tie up capital that essentially just “sits there” – grinding you to shreds.

Forex moves a lot slower than most short-term traders initially understand ( getting caught up in the smaller time frame volatility / chop ) when “in reality” – price is going nowhere.

More in the Members Area

Curreny Wars Turn To Trade Wars – People Next

From a purely geopolitical point of view things just keep getting hotter.

An expected “bounce in risk” ( considering the oversold conditions ) not as forth coming here as Putin pushes back with sanctions of his own BANNING EUROPEAN FOOD IMPORTS ( something which will further push Europe into a triple-dip recession ).

“Take that” then Obama / EU cronies.

Apparently the big boys in Washington and The EU are both completely shocked and outraged ( yet imposing sanction of their own is always Ok – right? )

Putin will not be bullied, now with the “supposed recovery” in The EU ( ya right ) hanging in the balance. Like it has anything to do “what so ever” with Putin or Russia.

This is now coming to a head as the West continues to do anything possible to provoke the “calm cool and collected” Putin.

The U.S must make war in order to retain “reserve currency status” and continue with the Ponzi at whatever cost.

Putin’s latest action keeps the game in check, and provides hope for those of us ( most of the planets population ) who look forward to a day when The U.S looks to concentrate on its own “completely f#&ked up situation”, starts taking care of its “own people” and keeps its big fat “overly indebted nose” out of other people business.

You’d think the people of The Ukraine were “made of gold” considering the amount of interest from Washington! No wait…….gas/oil – that’s it.

Currency wars turn to trade wars…….

Trade wars turn to “people wars”.

Hey – what’s up fellow traders? I know the flow of “daily trading info” has dwindled to a certain degree here at the public blog as it’s now “hopping” in The Members Area!

Things are really looking to pick up here in coming days / weeks with “The Fed news” late August as well current weakness in global equities assuring fireworks to follow!

Come check it out at www.forexkong.net

Navigating The Turn – 2 Years Without Returns?

Considering that markets have more or less “skyrocketed higher” for such an extended period of time that the majority of investors / traders are likely convinced that this is just the “new normal” ( I can’t stand that expression by the way – as it reeks of complacency and “idleness”) and that dips should be bought, on and on, no worries, The Fed has your back etc etc…

It’s easy to understand, as even heightened geopolitical concerns continue to take the back seat, along side lowered global GDP forecasts, poor data out of Japan etc..It could easily appear to the casual observer that “nothing” can get in the way of markets just moving higher, and even higher.

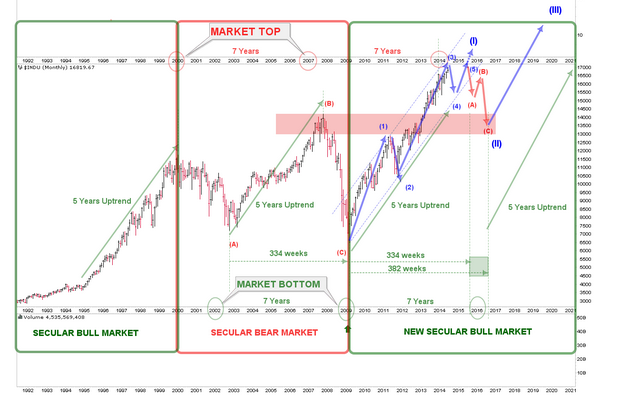

But what happens when the turn is made? I mean…..we all have to appreciate that “nothing goes up forever” right? Historically speaking we can see the typical “boom and bust cycle” usually manifests in a “5 year up and 2 year down” type scenario – and we’re well past the 5 year up mark.

As investors / traders it would completely foolish to “simply ignore” these longer term patterns as I can imagine most of you…..have likely been caught doing that a time or two before right?

Tech / boom / crash 2000 maybe? Credit / housing / crash of 2007 perhaps?

I find it highly unlikely that many of you successfully navigated these “significant turns” to continue generating profits during the 2 year period following these incredible crashes in risk.

Take a look:

Market tops can be seen almost “to the letter” on a 7 year cycle with 5 years up….and 2 years down, with us sitting “right at the max” of this “extended 5 year move higher” based solely in the “money printing efforts” made by Central Banks.

The idea of going through this again ( as why would this time be any different? ) can’t possibly be appealing. Considering where you are in life, and the prospects of a “full 2 years” with your portfolio drawndown considerably – not to mention the mental and psychological end of things – who needs the grief?

You’ve come this far with your investing / trading decisions while the “good times have been good” so…..why not extend the same effort when ” the good times are bad”?

Suggestions to follow….

Forex Markets Frozen – Risk Comes Off

If anyone’s had question as to “just what extent” the Central Banks have got their hands wrapped around these markets – you’ve gotta love this.

A -34 point loss on The SP 500 as U.S Equities erases 2 full months trading in a matter of hours, while the U.S Dollar ( and the entire currency market for what it’s worth ) remains unchanged.

Honestly, on a day like today ( perhaps a year ago ) I would have been dancing around the patio naked, with a sombrero and the Ipad, busting a gut at the ridiculous amount of profits made with my “short risk” positions – but today?

I can’t freakin well believe this. The entire Foreign Exchange Market is on lock down.

The U.S Dollar has moved all of 15 pips vs JPY and for the most part, not a single currency has made a move “any larger” than one might expect during a typical “hour” of normal trading. It’s like nothing has even happened!

Frankly, I’ve never ( in my entire career trading ) seen anything like it, and find this to be extremely concerning.

If a “day like today” can’t get this thing off it’s ass – WTF???

As these things don’t turn on a dime – I understand, but in this case we’ve got a real anomaly here.

This MUST be setting up for something far larger.

USD/JPY – A Pair You Can Learn From

We’ve discussed how important this pair is with respect to it’s “drive in equity markets” ( with JPY being sold/borrowed then converted to USD in order to purchase equities ) and it’s interesting to note that:

Regardless of whatever fluctuations we’ve now seen around Yellen’s “slightly more hawkish” comments….USD/JPY refuses to break higher thru the downward sloping trend line that has contained it for so long.

What would appear as “USD strength across the board” really only manifests as a couple pips rise in USD/JPY.

This is because strength in JPY is even GREATER. With both currencies taking inflows only JPY taking MORE creating a net result of USD/JPY falling “lower”.

This may appear counter intuitive as one might imagine “well USD is going higher….this pair should also be going higher right?” WRONG.

Understanding the fundamentals behind this pairs movement can tell you a lot about market’s appetite for risk as “USD will be converted BACK to YEN as U.S equities are sold.

A stronger Yen correlates to “weaker U.S Equities” near 95%.

Something to add to your toolbox if it’s not already in there.

I’m adding short USD/JPY here at 101.63

Future Moves In USD – The Case For Higher

I can’t stand The U.S Dollar.

You know that…..everyone knows that. The actions of The U.S Federal Reserve with it’s complete and total disrespect for the currency and continued abuse of it’s position as the “world’s reserve currency” is enough to make anyone sick.

So when would we start looking for USD to move higher? Why would we even “consider there a chance” for this beaten down piece of junk to go anywhere but down the toilet?

Hmmmm………

What many fail to understand is that “the value of a given” currency can only be deemed in “comparison” to another currency…or another asset. The pieces of paper themselves carry no intrinsic value what so ever.

Consideration of “dollar strength or weakness” as compared to a single thing ( like The Euro for example ) is ridiculous as….it is exactly that – a “comparison” of only two given currencies.

So……..

How’s the U.S Dollar stacking up against The Canadian Dollar?

Looks like a fantastic buy opportuntiy as USD has merely “pulled back” vs Cad.

USD vs CHF looks like a pretty classic reversal over the past few months, making a higher high, breaking the series of lower lows and lower highs. A swing low “somewhere in here” would mark a fantastic entry point long.

What about Crude Oil?

Pretty straight forward. When the price of something “goes down” in can equally be argued that the “value of the money” you are using to purchase such products has “gone up”.

What many just can’t wrap their heads around ( one dumb fellow in particular ) is that “there is no blanket statement” in considering being “long or short” USD as it only depends “against what”?

Another chart “sniffing out” coming USD strength:

A good indication of a stonger dollar can be seen when Emerging Markets start to fall.

Imagine all that “free paper money” printed by The Fed and in turn “invested abroad” as to actually get some return ( you don’t actually think the banks invest the money they get from The Fed in “America” do you? – Please.) piling back into U.S bank accounts / converted back to U.S with concern for a possible rise in interest rates.

An absolute “sunami” of USD floods out of Emerging Markets and back into the United States, on even the smallest “hint” that interest rates may rise.

But……Interest rates ARE rising! In fact….( how soon you forget ) that interest rates on the 10 year U.S Treasury have DOUBLED in the past year and a half!

Rising interest rates cramp corporate borrowing and in turn kill bottom lines. A rise in rates pushes USD up, as well equities down.

Rates have already reversed, adding more fuel to the fire if considering a stronger dollar.

The short term squiggles are more or less meaningless at this point as…..The Fed and Central Banks abroad are just doing what they can to grind this thing a little longer before shit hit’s the fan.

How much longer can they keep this propped up? Not much longer if you ask me.

Forex Market Solved – Here’s What’s Next

It’s unfortunate that we’ve been so patient these days, only to now find the odd “profitable trade” finding itself slightly “back in the red” – with the huge ramp up in both The Nikkei as well SP 500 ( our risk barometers ) on absolutely no news “if not” bad news.

So is forex.

The great news however is…..we’ve “still” not missed a thing! and for those who’ve been slightly “wary” of the current trade environment ( wonderful…as you well should be ) a number of trade opportunities are not only “very much in play” but perhaps even “better looking” than some days or even weeks ago.

Let’s take a quick recap.

Short AUD/JPY here “again” at 95.00 or ( as I often suggest ) several pips lower and allow the market “momentum” come to you.

Re short GBP/JPY here at 171.80 area is the exact same entry we took some days ago then banked 200 pips on it! Exact same thing – right here right now.

With over 900 pips banked in the last 30 days, this is setting up pretty sweet for a complete and total “re run” as markets continue to hang at all time highs.

We’ve got piles of trades in the works now, with the “near to medium term analysis” in the bag.

Come trade with us at www.forexkong.net and get the full run down, weekly reports, daily commentary and real time trade alerts.

4 More Days – USD Toast Or Treasure?

If you can believe it – the U.S Dollar has spent the entire last week “still hovering” near a well-known area of support, showing absolutely no interest in “getting off its ass” and making a move higher.

As forex markets have a tendency to move sideways for extended periods of time, this should come as no real surprise but in having held a number of small positions ( almost averaged out now ) “long USD” for some time now, I’m only giving it a couple more days before just “going with my gut” and likely pulling a “stop n reverse” – getting back on the short side of this dud.

The overall weakness and lack of any real “life” suggests ( as I’ve now suggested for some days ) that regardless of any “near term pop” – USD looks pretty much set on breaking support and continuing on its merry way – into the basement.

Considering the lack of movement ( in either direction ) scratching a trade that has consumed nearly two full weeks of trading doesn’t put a smile on my face. Not at all. If you consider the time and effort, and in turn the “lack of reward” you can easily see why we call this “work”.

I’ll give this dud a couple more days to “prove itself” but as it stands…..I’m a hair away from flat-out “stop and reverse”, wherein the probability of an actual “waterfall” exists.

It’s make it or break it time for USD. 4 days Max.