Tagged: trading tips

Back On The Big Short – The U.S Dollar

Knowledge is power right? Or so they say….

So…..if you’ve only got a view of oh…let’s say just a small portion of the market ( maybe a couple of blue chips, gold) and perhaps the U.S Dollar “against” your own local currency well…..one might suggest adding a couple more “market indicators” to the pile.

I know you may find this incredibly hard to believe, maybe even IMPOSSIBLE to believe but….The U.S Dollar “spike” here in the wake of Brexit market madness will soon provide one of the greatest “short opportunities” of our time ( slight exaggeration perhaps ).

While you’re all drooling over the massive moves “upward” against both the EUR and GBP ( no kidding right? As the vast majority of traders got “wacked” by Brexit ) The U.S Dollar “continues to sink” against its arch rival ( or at times good buddy ) the Japanese Yen (JPY).

The two are now almost at par.

Now….for those with near term memory loss – do you remember the continued explanation here at Kong with respect to money flows on this planet? The safe havens / funding currencies such as JPY going absolutely “parabolic” during times of “risk aversion”? The money that comes “flooding back” to these this currency as large-scale “carry trades” are wound down? Well……if you think the U.S Dollar is strong right now……why is it getting its ass kicked by the Yen? Why is USD losing all support / falling like a rock against JPY?

That’s what I call JPY stength. That’s what I call “risk off”.

The U.S Dollar will soon follow….providing for large scale gains SHORT USD against any number of currencies.

I will again be waiting for a daily “swing high” in USD ( likely within the next 3-4 days tops ) for another joyous ride “back on the big short” – USD.

Pack yer bags…this could be a loooong journey.

Stop And Reverse – Day 3 Already

Why not take a quick second to blow my own horn right? I mean…….why not!

Day 3 of the full “stop and reverse” on The U.S Dollar – timed exactly,faultlessly, superbly, superlatively, excellently, flawlessly, to perfection, without fault, ideally, inimitably, incomparably, impeccably, immaculately, exquisitely, consummately. Bang! After week s of pure profit on the short side….3 days straight up long. Job well done for those of you that actually trade.

In any case…..always a great feeling when you nail one….or two – maybe 3 in a row, as it certainly makes up for the couple that you get 100% completely wrong.

By the strength of the move in USD I think it’s fair to say we’ve got ourselves an intermediate bottom, a fantastic entry and many more days of upside so it’s unlikely I’ll be changing my tune over the next few weeks. Mind you….I will be there for the next turn lower…you can count on that.

This is a great time to get those gold and silver miners back on your radar, and start zooming in to find solid areas of support. I hope these little babies fall hard, as the longer term reversal is now so…. major weakness will provide buying opportunities.

Rock n roll people.

Hope you’ve managed to make a buck er two. I’m back on the beach.

Trading Is Art – Filter Out The Noise

The U.S Dollar likely has a few more days of downside before petering out and completing this last leg lower, so you can feel free to hang on – at least another couple of days short.

HOWEVER!

It’s quite possible that this last leg down may mark “the end” of an intermediate down trend, where in the bounce ( and possible trend change ) could be quite dramatic.

Myself…..I’m going to close my few open positions over the next day er so…..then consider “mission accomplished” short / medium term shorting USD.

If indeed we see an intermediate cycle complete – a full stop and reversal in USD related trades could soon provide another “easy trade” in catching it so early. Obviously pairs such as EUR/USD as well GBP/USD will provide fantastic vehicles here, as well as long USD/CAD and USD/JPY ( but I’d be sure to really wait on these ).

So you see? This is traaaaaaading. Trading yes. Not beating down on The U.S Dollar like I give a rat’s ass about one particular currency or another. This is making money in a market “regardless of direction”. This is charting, this is macro economic analysis, this is timing – this is art, not some bullshit rhetoric aimed at keeping you invested and ultimately cleaned out.

You can do it…….you’ve just got to turn your biases off. You’ve got to learn to think for yourself, and filter through the noise.

Step Outside – Embrace Death – Start Living

You think I could pull this off if I was scared?

I know you……..

Well…..I know some of you.

I know a handful of successful people who kick around here on occasion – likely getting a bit of a charge out of good ol Kong as….these are people who have weathered their own storm, and can relate. People who’ve made sacrifice, people who’ve taken chances. People who’ve thrown “caution to the wind” to realize their dreams.

People that recognize you don’t get anything for free in this world, and that nothing…..and I mean NOTHING can stop you if you work hard and believe in yourself.

Is that you?

Or are you some “lurker” here fishing for a “free tip” – hoping you’ve lucked into the “lotto blog” and your wildest hopes/dreams will be instantly realized in doing what I say…..no effort….no sacrifice……no “self belief”?

Have you lost your mind?

In any case……….

I’ve been invited to a party this evening. A friend here in Playa. A very successful gent from Holland running a very successful beach bar and club. A celebration of birth on a level you’ll likely never see in your life.

I’ll pass thank you.

This is how it works for me…….

I’m not much for “birth” as much as I am for dieing.

If I didn’t approach it this way – how could I have lived this incredible life?

If I didn’t have complete and total belief / conviction that this “brief time in human form” was exactly that well….how could I possibly have done the things I’ve done? Imagine if I lived a life “in fear”?? How could I know what’s possible?

Do you know what’s possible? Do you know what you are capable of? Are you scared to die – or perhaps scared of living? Do you think you know the difference?

Total bullshit.

The sooner you start thinking/believing you are “eternal” and that this “brief stint as a werkin joe” is just a stop over – the sooner you and I start getting along.

Don’t do anything stupid ( short of the standard stupid shit we do ever day ) but seriously….

Step outside. Embrace death…….and you never know – you might just start living.

This blog is gonna change soon. I’m bored stiff with the simple math of trading.

Psychology coming soon to a theatre near you.

Stay tuned er bug off.

USD Cycle – New Daily Cycle Begins

The short USD Trade has been all too kind.

Have a peak at some “marketing timing” as a new daily cycle now begins for USD. I’m obviously 100% completely cash.

For the brave at heart – full reversal trade here….feel free to take a couple of days on the long side if you like.

Not for me….as I trade with the trend, but I’m sure you’ll squeeze a couple of days ( maybe as many as 6 ) long here if ya like. Have at it.

I’m hitting the oysters hard. No plans to trade for at least the coming week.

USD Devastation – USD/JPY Over The Edge

Absolutely incredible.

Silly people clinging to their television sets, clinging to their currency – still clinging to the ridiculous notion that “everything is going well”.

Straight up…..anyone suggesting that you “buy” is likely a banker, a broker or some dumb ass blogger with a single strategy ( or total lack of strategy ) appealing to you on the only level they can.

The notion that “bears are negative” and bulls are “positive” is completely and totally ridiculous as this is a “market” that trades in both directions. If you can’t develop strategies for the “red candles” how on earth do you possibly think you can be successful? Just buy and hold? Just “buy” cuz you are “optimistic about the future”? Dumb.

I’m as optimistic as it gets. Building my spaceship, saving my pennies for the liver transplant I expect to get somewhere down the road..plotting my investments in Graphene and spending my spare time plugging away at the latest developments in physics. The future looks amazing! But what the f#@k does that have to do with making money in the markets?

Blind optimism has no place here. It’s actually pretty irresponsible.

Since the vast majority of you don’t even trade Forex, it’s very likely that you lack proper context. If you dig back into the blog, you’ll find countless references to the fact that “currency markets lead all other markets”. Pretty straight forward considering that you need “money” to buy stocks so…….there it is. If you’re watching the money – you will always be one step ahead.

So what’s the deal with my USD Short Trade?

The deal is – it’s been 8 straight days since entry, and the trade has been amazing.

The US Dollar has absolutely cratered against it’s “printing partner/funding currency” the Japanese Yen. Didn’t hear too much about it in the news? Not surprising.

USD/JPY has fallen 1700 pips ( yes that’s right – 1700 pips! ) since markets topped out some months ago., and is quickly approaching “intervention territory” as far as The Bank of Japan goes. The huge move in Japanese Yen – a Tsunami for the Japanese economy.

I’m banking profits, as well letting a couple of these trades run with a tight stop as the money has already been made on this recent “leg lower in USD” but don’t be mistaken.

There will be another one coming. Bank on it.

Earth Sells Off Hard – Lower Lows To Follow

With over a month of inactivity short of holding the same positions, the same strategy as outlined here countless numbers of times – our old friend The U.S Dollar has done us proud.

The “dumb buck” has lost some 1000 pips v.s the Japanese Yen since markets topped some months ago, and has made an equally bad showing against the majority of its rivals.

This has only just begun.

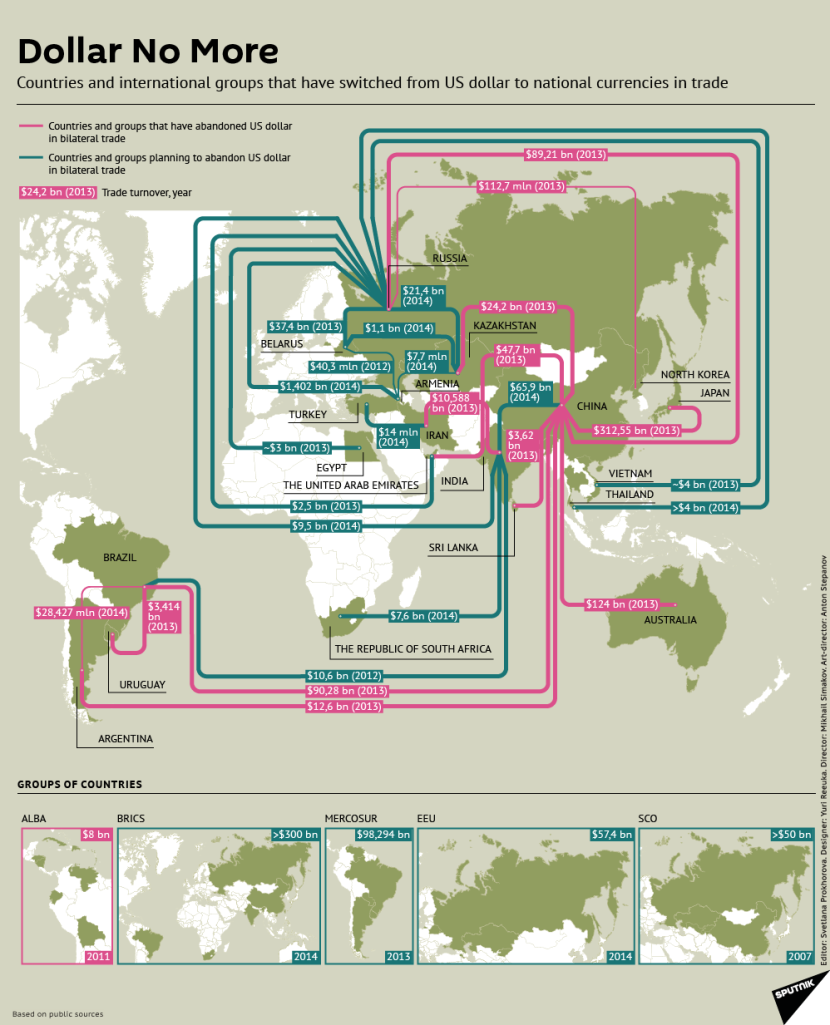

You may recall chatter some months ago about China and a number of other countries moving away from use of The Dollar in international trade, and recent news suggests that now Iran ( with sanctions being lifted ) is looking to sell its oil in Euro only.

Unfortunately you just can’t have it both ways.

Things will only spiral further down the drain when U.S interest rates go negative ( where essentially they are already if you consider inflation ) and The Fed looks to launch QE5.

All those worthless dollars already printed…..and a shit pile more coming soon – to an unemployment office near you. This is no time to be disappointed or upset! Rejoice in your new-found knowledge that the entire “economic recovery” has been a complete and total sham, and be glad you made the realization early enough to survive.

Have you survived? I hope so.

And it’s really not too late…unless of course you are still of the mindset that “The Central Banks” have got your back well then…….one would think you’d of learned your lesson over the past month er so.

Earth is selling off hard. There isn’t a damn thing “they” or “anyone” can do about it.

Global stock markets are literally “tanking daily” and in my view things are just getting started.

From a technical perspective we’ve only just “shaved the top” off this mountain off bullshit, now with The SP 500 still hanging around the neckline area of support – but that won’t last much longer.

New lows…..then even “lower lows” to follow as The U.S Dollar plummets, Japanese Yen come flooding back to the country where they were printed, Euro and GBP remain elevated and the commodity related “currencies” trade flat.

A low in oil at some point ( correlating with the dump in USD ) won’t mean the markets will recover…not in the slightest as oil will then just bounce along said bottom for eternity. No immediate opportunities there.

People are flat busted, food prices are “out of this world” and global economic data is quickly turning from bad to horrific. This is not a blip. This is not a “correction”. This is not a drill.

This is 2016 baby….and it will be one for the books.

Weekly Charts – Confirmation We Go Lower

The weekly charts in SP 500 and Dow now clearly broken.

We move lower here….like weeks lower…so don’t get caught buying dips!

We sell rips in this environment so what you are looking for are strong “daily closes” in order to find higher levels to continue to “add short on”.

Find “max green” intra day / week to continue loading short.

Long JPY the biggest winner ( as you guys already know this! ) with Commods like AUD getting punched in the knee.

Looming buys in both EUR and GBP vs USD but likely not for a few days…..legging in as soon as this evening / late afternoon tomorrow.

Year 2016 Starts Now! – Get With The Program!

A fantastic start to the new year with equity markets in particular – showing their hands early.

Today looks fantastic as currency markets are essentially `giving us the day to catch up`….with little movement in USD itself – but OBVIOUS movement in JPY as risk sells off hard.

You guys know this…..this should look very straight forward at this point as the clear trade is still Long JPY vs Commods….as well short USD coming up here again soon.

These pairs are a given as risk falls off the cliff, while we get another full day ( or two more perhaps ) before USD rolls over and `those` pairs get added to the pile.

I wish it was more exciting at times too folks…however after a time…this just gets redundant.

We are going lower…..days lower…….weeks lower.

Japanese Markets Crashing – Monday Comes More

The Japanese Nikkei Index is down nearly 3% ( -525 ) and it’s not even lunch time in Japan.

Care for a dynamite roll? Lol. Markets are imploding.

As suggested here countless times in the past…..just tune into to The Nikkei on Sunday nights for your early morning trade strategies there in the U.S. as it would be a very rare occasion that such destruction over seas doesn’t hit the shores of America come sunrise. When will you expand your circles of influence wide enough to truly get a grasp on this thing we call a “global economy”?

CNBC and the Wall St. Journal just won’t cut it girls.

I am making “sick money” long JPY since last week ( you could be too ……..but wait….the trade involved discussion/concepts of something “asian” so……its more than likely you “let nothing but patriotism stop you” ) – bleeeep! Red button. Some silly buzzer going off on some hilarious Japanese game show set – YOU LOSE Honky.

It’s a “global economy”! You seriously don’t believe it? How long can the television continue to guide you?

Now I’m not asking you to consider ducking out on your “trailer pad rental”, packing up Grandma and yer guns and moving to Canada ( at least Canada “admits” it’s in recession with back to back quarters of negative GDP growth now in the can ) – Juuuuust hoping to alert you to the stark realities of the current situation.

If you haven’t sold yet – you are not going to be the happiest camper moving forward.

Forex markets don’t give a rat’s ass about you, so if you can keep your eyes on the fundamentals and “not” on the tube. You’ll do fine.

Tomorrow morning the entire move with “have already happened” pre – market ( ya…actually it’s called Japan ) and the most likely scenario will see Western investors pile in short around 10:30 a.m thinking they’ve “scored a tip” here Sunday night.

Wall St. will then strip you clean ( ramping the thing into the late afternoon ) then sell hard into the close.

That…….or perhaps a fake alien invasion and an address from your leader.

I stand impartial ( this is my forex blog……..so you can imagine my thoughts on other “more interesting things” ) so take it with a grain of salt.

I trade to make money….I blog to help you.

Try your best not to get the lines crossed here k?