Tagged: dollar top

Back On The Big Short – The U.S Dollar

Knowledge is power right? Or so they say….

So…..if you’ve only got a view of oh…let’s say just a small portion of the market ( maybe a couple of blue chips, gold) and perhaps the U.S Dollar “against” your own local currency well…..one might suggest adding a couple more “market indicators” to the pile.

I know you may find this incredibly hard to believe, maybe even IMPOSSIBLE to believe but….The U.S Dollar “spike” here in the wake of Brexit market madness will soon provide one of the greatest “short opportunities” of our time ( slight exaggeration perhaps ).

While you’re all drooling over the massive moves “upward” against both the EUR and GBP ( no kidding right? As the vast majority of traders got “wacked” by Brexit ) The U.S Dollar “continues to sink” against its arch rival ( or at times good buddy ) the Japanese Yen (JPY).

The two are now almost at par.

Now….for those with near term memory loss – do you remember the continued explanation here at Kong with respect to money flows on this planet? The safe havens / funding currencies such as JPY going absolutely “parabolic” during times of “risk aversion”? The money that comes “flooding back” to these this currency as large-scale “carry trades” are wound down? Well……if you think the U.S Dollar is strong right now……why is it getting its ass kicked by the Yen? Why is USD losing all support / falling like a rock against JPY?

That’s what I call JPY stength. That’s what I call “risk off”.

The U.S Dollar will soon follow….providing for large scale gains SHORT USD against any number of currencies.

I will again be waiting for a daily “swing high” in USD ( likely within the next 3-4 days tops ) for another joyous ride “back on the big short” – USD.

Pack yer bags…this could be a loooong journey.

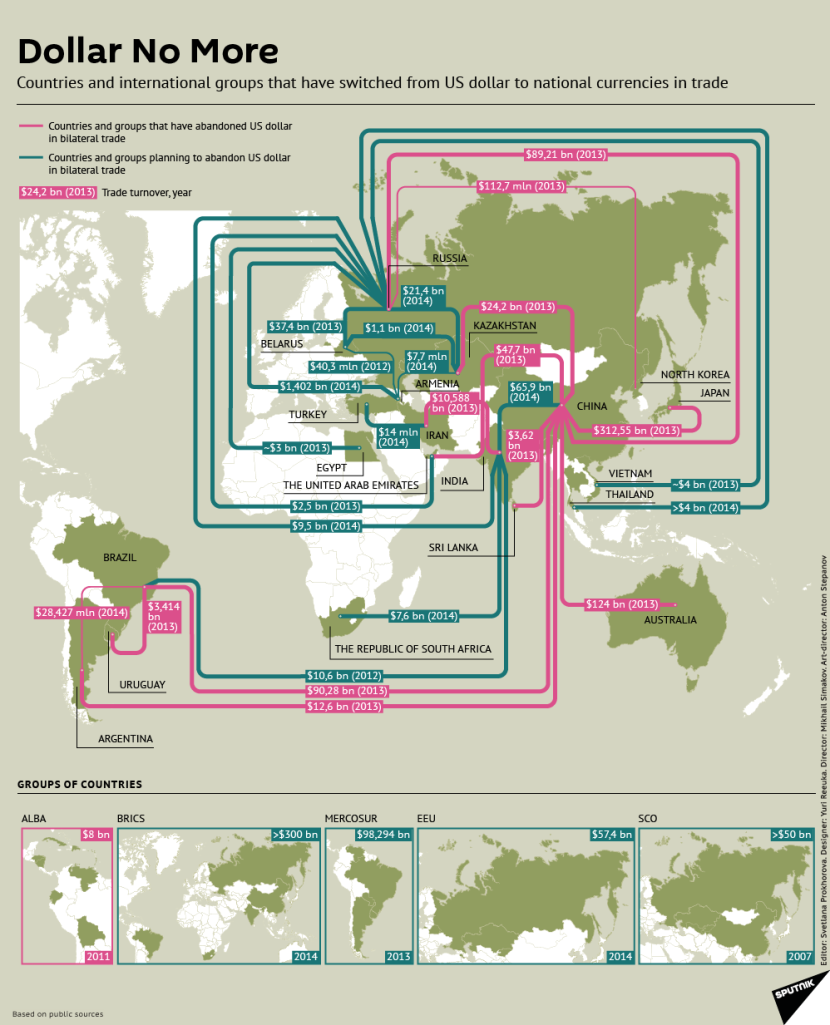

Dollar No More – A Global Perspective

I took this graphic from “somewhere” as it’s a great visual representation of what is “really going on” with the U.S Dollar and international trade.

Don’t be a dope. If the arrows and numbers where pointed in the “other direction” then perhaps you could build a case. The numbers speak for themselves. The U.S “strangle hold” on the world’s reserve, and in turn “slice of the pie” generated via currency exchange ( in order to buy commodities ) is over.

Falling Oil Prices = Slowing Global Demand

With readership here at Kong now doubling “again” over the past few months – I struggle to understand what “new information” people are looking for.

You do understand that the recent fall in oil prices ( well …actually not so recent considering it’s been falling like a rock since June – down from 110 to now 58 bucks a barrel ) is a blatant and obvious indication that “global growth” and “global demand for oil” is falling off a cliff right?

Seriously…….if you don’t see the connection between “supply and demand” in something this blatant and simple well…….one has to wonder “what you do see” – if anything relevant at all.

Finally something “other than The Fed / mainstream media bullshit” to get you off the couch and start asking yourself?

Could it actually be? You mean all this Kong talk of “global slowdown” over the past months ( despite the ridiculous rise in equity pricing ) is actually for real?

Give your head a shake. The world outside your tiny bubble of plastic wrap and pizza boxes is selling off like hotcakes and you still think Apple looks like a buy here at 110.

Oil related currencies such as The Canadian Dollar as well The Mexican Peso are getting creamed even as The U.S Dollar is falling hard, and The Japanese Yen enters “lift off stage”.

Debate over the next couple weeks and “what ever miniscule points are left” in the general propping up of both Japanese and American markets is a dead mule.

Step back and imagine oil at 30 bucks…perhaps that will get your attention.

Markets Set To Roll Over – All Things Say Yes

We are very close here folks.

Aside from the currencies, nearly every other thing I track / read / research suggests that this may not only be a strong area for “correction” – but the start of something much larger.

There has rarely ( if ever ) been a time in history when as many separate indicators / charts / graphs and info has been “this skewed” to suggest such divergence and risk of serious “downside action in global appetite for risk”.

Considering the current geopolitical backdrop and with U.S Equities still “clinging” to the highs, personally – I don’t see a blow off top scenario. To whatever degree that retail investors have “taken the bait” over the past 7 months….I believe they are “already in”.

The situation with Ukraine really only being the tip of the iceberg now as Putin’s “Gazprom” now announces “massive oil deal with China” again…bypassing the U.S Dollar in trade. These are tremendous blows to the U.S system, and make clear The U.S “true intension” in Eastern Europe.

They must save the U.S Dollar as world reserve currency – and will stage a war to do so.

The Nikkei rolled over a couple of days ago, USD looks set to plunge along with equities, and the entire currency market has more or less moved “risk off”, with USD/JPY “not breaking out”, falling back into range and expected to fall further.

The real-time trades in currencies, gold and silver as well U.S Equities, weekly reporting and daily commentary can be found at the members site: Forex Trading With Kong.

Citi Sells All USD Positions – No Really?

Again….you generally need to be “ahead of these moves” in order to take advantage ( note yesterdays post- please scroll down ).

Gold, & Silver Jump As Citi Sells All USD Positions Fearing “Squeeze”

I envision a time ( in the not so distant future ) when “all things American” ( USD, Stocks and most certainly the bonds ) are sold.

I’m sure you’ve noticed the correlation of USD strength = U.S Equities strength so…..one would have to imagine the complete and total “inverse relationship” as well right?

Or they just all keep going up forever. RIght.

Little chance of that.

Other than the few short USD positions already in play I’m more or less “cash ready” for the large positions “long JPY” ( against most every other currency on the planet ) kicking in here soon.

No shorts in SP 500 as of yet.

More at the Members Site: Forex Trading With Kong

Forex Markets Come Alive – USD Wash Out

Wow.

A very large “gap up” here in the wee hours Sunday night before markets really kick off, and the U.S Dollar continues to surge higher against the E.U currencies.

One can’t imagine a single USD bear left on the planet.

Exactly as it should be…. before the thing tanks.

It’s amazing to me how public perception continues to view USD’s recent surge as “some indication” of a stronger U.S Economy.

How on Earth can The U.S Governement ( as well the crooks at The Fed – a private held bank ) handle the enormous contribution to the “serviceable debt load” ( remember The U.S is “officially broke”, with a continued rise in the “allowable debt ceiling” now just a given ) brought about by a stronger U.S Dollar?

It’s impossible. The Fed mandate is to “kill USD” at whatever costs, as to keep these balls in the air as long as they possibly can.

A strong U.S Dollar “kills” the U.S economy! As exports tank, and the amount/value of outstanding sovereign debt balloons “past” the balloon we already know to be.

Find me an “economist” who can make the arguement that “a strong U.S Dollar is good for America” and I’ll eat my hat.

A strong U.S Dollar represents everything the U.S Gov and The Federal Reserve fear most so….I encourage you to start looking for signs of reversal – as opposed to getting to excited.

4 More Days – USD Toast Or Treasure?

If you can believe it – the U.S Dollar has spent the entire last week “still hovering” near a well-known area of support, showing absolutely no interest in “getting off its ass” and making a move higher.

As forex markets have a tendency to move sideways for extended periods of time, this should come as no real surprise but in having held a number of small positions ( almost averaged out now ) “long USD” for some time now, I’m only giving it a couple more days before just “going with my gut” and likely pulling a “stop n reverse” – getting back on the short side of this dud.

The overall weakness and lack of any real “life” suggests ( as I’ve now suggested for some days ) that regardless of any “near term pop” – USD looks pretty much set on breaking support and continuing on its merry way – into the basement.

Considering the lack of movement ( in either direction ) scratching a trade that has consumed nearly two full weeks of trading doesn’t put a smile on my face. Not at all. If you consider the time and effort, and in turn the “lack of reward” you can easily see why we call this “work”.

I’ll give this dud a couple more days to “prove itself” but as it stands…..I’m a hair away from flat-out “stop and reverse”, wherein the probability of an actual “waterfall” exists.

It’s make it or break it time for USD. 4 days Max.

Trading Nightmare – I’m Awake And In Profit

One of my computers called me about an hour and a half ago.

Plucked from the grasp of yet another “unsettling dream” ( for what ever reason I am continually plagued by dreams of having my teeth pulled / ripped / removed / taken in ever increasingly “bizarre fashion” ) I welcomed the alert, and eagerly leapt from the bed to silence the soft repeating tone.

Several trades had been picked up, and to my surprise – the U.S Dollar taking a relatively huge hit as the London sessions moved into their first couple hours trading. My surprise? Of course not – you know that. Everything moving accordingly to plan with the added bonus of still having every single tooth intact! How wonderful!

And with so many caught in nightmares of their own, gobbling up useless news stories of tapering and the assumed effect of a “much stronger dollar”.

EUR and GBP are obviously the biggest winners here as per trades in the comment section some hours ago as well a quick tweet.

The “tooth removal” dreams are extremely unpleasant, and it’s really no wonder I don’t sleep a whole lot. Thankfully I was “saved by the bell” here this evening, and rewarded with some fantastic trade entries.

In celebration I plan to eat 3 lbs of chocolate, a full tub of ice cream and as many stale candy canes as I can wrestle from the kids across the street.

UPDATE:

I can fully understand that this must be moving way to fast for some of you as…..only hours later (in fact less ) I’ve already banked just under 400 pips across the board in 6 pairs total, and will now be looking for pull back on smaller time frames – and of course re entry.

When some of this goes down in the “dead of night” I don’t imagine there is much some of you can do about it , not having the alerts / computers chiming, the lifestyle ( never sleeping, no kids , no other job, likely insanity ) let alone the interest / dedication / commitment.

We’ll have to find a solution moving forward.

U.S GDP Data – Totally Bogus

You can get in here and argue your case til the cows come home! – and I honestly hope that you do, as perhaps you’ve some insight / information that can better help me understand.

The U.S data released this morning is absolutely hilarious. Not just “kind of funny” but so absolutely outside the realm of believable that I’m literally “on the floor laughing”.

Let’s see what the markets make of both this “ridiculous GDP number” and the “magical drop” in unemployment.

I’ve only added to USD shorts as well watching Japan continue to slide with long JPY’s starting to take shape.

Short and sweet this morning, as I want to get “back to the circus” as soon as possible.

I’ve not had this much fun in a while!

USD will continue to be sold here.

USD Bullish Or Bearish? – You Tell Me?

I think it’s fantastic that I’ve “managed to wrangle” a number of intelligent readers here at Forex Kong, and that these guys also offer their opinions / beliefs / suggestions and projections.

You can surf around the net for a “looooooong time” searching for some of the “nuggets” that turn up in the comments section here at the site, with a large portion of these insights coming from a “small handful” of some mighty intelligent people.

Yesterday’s post on “the proposed downward slide of the U.S Dollar” brought about a couple of fantastic “alternate views” which I appreciate in that – we enter the world of “speculation” when we start looking out over longer periods of time – where in theory “it’s impossible” for anyone to “actually know” how things will play out.

Throwing the ball around with others allows for a better perspective, an acceptance of alternate views and an “opening of the mind” should you be so closed as to only consider your own ideas, as correct.

The future path for the U.S Dollar (having such impact on all else) seems like as good a place to start as any so…..I welcome “any and all” to weigh in on this post ( as I will leave the comments section open for eternity ) as to provide a lasting resource for readers in the future.

USD bullish or bearish? You tell me?