Tagged: dollar devaluation

Back On The Big Short – The U.S Dollar

Knowledge is power right? Or so they say….

So…..if you’ve only got a view of oh…let’s say just a small portion of the market ( maybe a couple of blue chips, gold) and perhaps the U.S Dollar “against” your own local currency well…..one might suggest adding a couple more “market indicators” to the pile.

I know you may find this incredibly hard to believe, maybe even IMPOSSIBLE to believe but….The U.S Dollar “spike” here in the wake of Brexit market madness will soon provide one of the greatest “short opportunities” of our time ( slight exaggeration perhaps ).

While you’re all drooling over the massive moves “upward” against both the EUR and GBP ( no kidding right? As the vast majority of traders got “wacked” by Brexit ) The U.S Dollar “continues to sink” against its arch rival ( or at times good buddy ) the Japanese Yen (JPY).

The two are now almost at par.

Now….for those with near term memory loss – do you remember the continued explanation here at Kong with respect to money flows on this planet? The safe havens / funding currencies such as JPY going absolutely “parabolic” during times of “risk aversion”? The money that comes “flooding back” to these this currency as large-scale “carry trades” are wound down? Well……if you think the U.S Dollar is strong right now……why is it getting its ass kicked by the Yen? Why is USD losing all support / falling like a rock against JPY?

That’s what I call JPY stength. That’s what I call “risk off”.

The U.S Dollar will soon follow….providing for large scale gains SHORT USD against any number of currencies.

I will again be waiting for a daily “swing high” in USD ( likely within the next 3-4 days tops ) for another joyous ride “back on the big short” – USD.

Pack yer bags…this could be a loooong journey.

Markets Set To Roll Over – All Things Say Yes

We are very close here folks.

Aside from the currencies, nearly every other thing I track / read / research suggests that this may not only be a strong area for “correction” – but the start of something much larger.

There has rarely ( if ever ) been a time in history when as many separate indicators / charts / graphs and info has been “this skewed” to suggest such divergence and risk of serious “downside action in global appetite for risk”.

Considering the current geopolitical backdrop and with U.S Equities still “clinging” to the highs, personally – I don’t see a blow off top scenario. To whatever degree that retail investors have “taken the bait” over the past 7 months….I believe they are “already in”.

The situation with Ukraine really only being the tip of the iceberg now as Putin’s “Gazprom” now announces “massive oil deal with China” again…bypassing the U.S Dollar in trade. These are tremendous blows to the U.S system, and make clear The U.S “true intension” in Eastern Europe.

They must save the U.S Dollar as world reserve currency – and will stage a war to do so.

The Nikkei rolled over a couple of days ago, USD looks set to plunge along with equities, and the entire currency market has more or less moved “risk off”, with USD/JPY “not breaking out”, falling back into range and expected to fall further.

The real-time trades in currencies, gold and silver as well U.S Equities, weekly reporting and daily commentary can be found at the members site: Forex Trading With Kong.

Citi Sells All USD Positions – No Really?

Again….you generally need to be “ahead of these moves” in order to take advantage ( note yesterdays post- please scroll down ).

Gold, & Silver Jump As Citi Sells All USD Positions Fearing “Squeeze”

I envision a time ( in the not so distant future ) when “all things American” ( USD, Stocks and most certainly the bonds ) are sold.

I’m sure you’ve noticed the correlation of USD strength = U.S Equities strength so…..one would have to imagine the complete and total “inverse relationship” as well right?

Or they just all keep going up forever. RIght.

Little chance of that.

Other than the few short USD positions already in play I’m more or less “cash ready” for the large positions “long JPY” ( against most every other currency on the planet ) kicking in here soon.

No shorts in SP 500 as of yet.

More at the Members Site: Forex Trading With Kong

Forex Markets Come Alive – USD Wash Out

Wow.

A very large “gap up” here in the wee hours Sunday night before markets really kick off, and the U.S Dollar continues to surge higher against the E.U currencies.

One can’t imagine a single USD bear left on the planet.

Exactly as it should be…. before the thing tanks.

It’s amazing to me how public perception continues to view USD’s recent surge as “some indication” of a stronger U.S Economy.

How on Earth can The U.S Governement ( as well the crooks at The Fed – a private held bank ) handle the enormous contribution to the “serviceable debt load” ( remember The U.S is “officially broke”, with a continued rise in the “allowable debt ceiling” now just a given ) brought about by a stronger U.S Dollar?

It’s impossible. The Fed mandate is to “kill USD” at whatever costs, as to keep these balls in the air as long as they possibly can.

A strong U.S Dollar “kills” the U.S economy! As exports tank, and the amount/value of outstanding sovereign debt balloons “past” the balloon we already know to be.

Find me an “economist” who can make the arguement that “a strong U.S Dollar is good for America” and I’ll eat my hat.

A strong U.S Dollar represents everything the U.S Gov and The Federal Reserve fear most so….I encourage you to start looking for signs of reversal – as opposed to getting to excited.

War, Silver, AUD, Putin, China = Fun

I feel I’ve gotten a little soft here during the past few weeks.

In not being as “overly thrilled” with the market as I normally am – the blogging has suffered as……if you don’t have anything good to say well……you know.

This tiny blip / risk aversion based on “at least two” of the black swans we spoke of last week restores some faith in the fact that markets are still markets, people are still people, and emotions are still emotions.

The Central Banks do all they can to lull you to sleep but in reality are relatively powerless against the “true forces” of fear and greed – where human emotion will always take the front seat.

Take for example the massive printing efforts in Japan – propping up the Nikkei. It’s all going to look pretty ridiculous as “only a matter of days” can erase “1000’s of points” in a heartbeat. Imagine when things really turn? ( as they will ).

Russia has put Obama back in his bunker with suggestion ( if not action already ) dumping U.S Treasuries as well US Dollar reserves alongside their good buddy China – essentially holding the capability to “level the U.S economy” without the use of a single missile. You gotta love that eh?

As suggested earlier Putin will not let these tyrants in Washington get their grubby little mits on Ukraine without a fight….and rightfully so (if you understood anything at all of the importance of Ukraine, and its massive network of natural gas pipelines that feed Europe).

Obama can kiss my ass. He’s beyond desperate, and essentially “toying with war” as Russia merely protects what it already has.

Me…..I’ve got important things to take care of over the next couple of days – “very” important things…so I will look for WWIII to start Monday at the earliest ………..and “never” at the latest.

Have a good weekend all – keep your eyes peeled late Sunday.

Short AUD – killer, and the long list of gold and silver miners entered “weeks ago” doesn’t hurt either.

Kong……..gone.

4 More Days – USD Toast Or Treasure?

If you can believe it – the U.S Dollar has spent the entire last week “still hovering” near a well-known area of support, showing absolutely no interest in “getting off its ass” and making a move higher.

As forex markets have a tendency to move sideways for extended periods of time, this should come as no real surprise but in having held a number of small positions ( almost averaged out now ) “long USD” for some time now, I’m only giving it a couple more days before just “going with my gut” and likely pulling a “stop n reverse” – getting back on the short side of this dud.

The overall weakness and lack of any real “life” suggests ( as I’ve now suggested for some days ) that regardless of any “near term pop” – USD looks pretty much set on breaking support and continuing on its merry way – into the basement.

Considering the lack of movement ( in either direction ) scratching a trade that has consumed nearly two full weeks of trading doesn’t put a smile on my face. Not at all. If you consider the time and effort, and in turn the “lack of reward” you can easily see why we call this “work”.

I’ll give this dud a couple more days to “prove itself” but as it stands…..I’m a hair away from flat-out “stop and reverse”, wherein the probability of an actual “waterfall” exists.

It’s make it or break it time for USD. 4 days Max.

Deflation Vs Inflation – The Great Debate

It’s pretty rare that I get excited about something like this as I don’t really spend a lot of timing thinking about – but in this instance, I’m really looking forward to learning more.

We’ve had some discussion in the comments section over the weekend, with a couple of very knowledgable participants really putting out some great info.

Deflation vs inflation…..the great debate.

I for one have thrown this around on occasion, only to find myself back where I started in the first place – time and time again. I hope I don’t create a “dead-end ” here (as I generally stick to spaceships, quiet time with ants, and the search for evidence of alien life on Earth ) and am certainly “not” an economist, but I hope we can wrangle these guys ( and whom ever else ) to shed a little light, on a an area of economics – often misunderstood.

The basics:

Deflation is a “decrease” in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Deflation increases the real value of money ie…..the currency of a nation or regional economy.

Deflation allows one to buy more goods with the same amount of money over time.

*Thank you Wikipedia!” ( what you think I rattled that off the top of my head?)

Inflation is a persistent “increase” in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy.

So…..in a nut shell – looking at the value of a dollar in a given economy, and the reflection of “how much of what” that dollar is able to purchase at a given time – no?

The questions:

Given the current monetary policy – Is the United States “currently” in an inflationary environment or a deflationary environment? And more importantly ( as we are all much more interested in the future )…..

Where do you see the United States headed next? And….(bumbuddabum bumbumbbumbbumb!!!)

Why?

Woohooo! I’ll do my best to chime in but in all honesty I’ve likely got little to add…other than my own “backward / flipped over / nutty way” of looking at it, which ultimately may not have to do much with economics as it does making money trading forex.

All opinions / views more than welcome!

Let’s get this thing licked! And thank you in advance to JSkogs in particular. A valued reader and contributor here at Kong, and from what I gather – a pretty all around great guy.

Gold And The U.S Dollar – Where To Next?

A fantastic question from another valued reader.

PT asks?

“Some time back you spoke of what readers wished to hear. So I thought I’d question a true professional. As a forex novice, my query pertains to gold, silver, and its shares.Where do you see the DXY in the intermediary term (3-6 months)? I know your trades often only last hours, but what is your “change” or expectation for the dollar going forward?”

Kong says:

We’ve seen the decoupling of the traditional relationship / correlation of “lower dollar = higher

gold” right? Or have we?

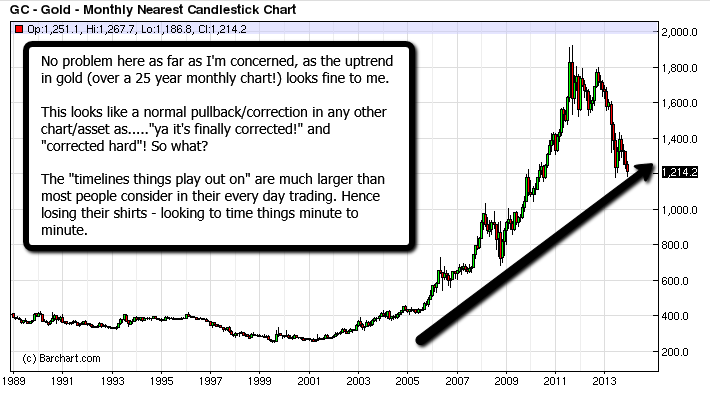

Pull a 25 year chart of gold and see that this “massive correction” isn’t really that massive at all.

Compared to any other asset / chart you see on the 25 year for example….this is ( Elliot boys

chime in please ) some kind of “wave 4” maybe…..but not a change in trend!

I have no change in expectation for the dollar ( as I expect it to essentially go to zero ) but will

be wary / watchful for correction “just like we see in all asset classes” when the time comes.

Knowing full well “nothing moves in a straight line for long” sure…..the buck will “buck us bears”

at some point…..as the correction in gold has equally “bucked the bulls”. This shit happens every

day, in one asset or another…..one chart or another.

What most people fail to understand is that “every single pivot / zig and zag” doesn’t play out/correlate/ “on a dime”. An asset like gold ( with such a high value ) has been “on it’s own correction” based on the value / time / zigs / zags etc, while the US Dollar struggles within it’s own set of parameters.

There are points where “stars align”, but in general “intermarket analysis” is extremely difficult for a novice to effectively “time”.

If you ask me what I think. I think the U.S Dollar is going to zero and I think that gold is going to the moon. If you ask me “how long is that gonna take”?

I’ll tell you you’re trading to large, reduce your position size, don’t expect this to be easy and “don’t” pull your life savings with any expectations that you’ll “be even close” in timing it.

Near term – I’m looking for this last leg lower in the dollar – then an obvious bounce.

Trading Nightmare – I’m Awake And In Profit

One of my computers called me about an hour and a half ago.

Plucked from the grasp of yet another “unsettling dream” ( for what ever reason I am continually plagued by dreams of having my teeth pulled / ripped / removed / taken in ever increasingly “bizarre fashion” ) I welcomed the alert, and eagerly leapt from the bed to silence the soft repeating tone.

Several trades had been picked up, and to my surprise – the U.S Dollar taking a relatively huge hit as the London sessions moved into their first couple hours trading. My surprise? Of course not – you know that. Everything moving accordingly to plan with the added bonus of still having every single tooth intact! How wonderful!

And with so many caught in nightmares of their own, gobbling up useless news stories of tapering and the assumed effect of a “much stronger dollar”.

EUR and GBP are obviously the biggest winners here as per trades in the comment section some hours ago as well a quick tweet.

The “tooth removal” dreams are extremely unpleasant, and it’s really no wonder I don’t sleep a whole lot. Thankfully I was “saved by the bell” here this evening, and rewarded with some fantastic trade entries.

In celebration I plan to eat 3 lbs of chocolate, a full tub of ice cream and as many stale candy canes as I can wrestle from the kids across the street.

UPDATE:

I can fully understand that this must be moving way to fast for some of you as…..only hours later (in fact less ) I’ve already banked just under 400 pips across the board in 6 pairs total, and will now be looking for pull back on smaller time frames – and of course re entry.

When some of this goes down in the “dead of night” I don’t imagine there is much some of you can do about it , not having the alerts / computers chiming, the lifestyle ( never sleeping, no kids , no other job, likely insanity ) let alone the interest / dedication / commitment.

We’ll have to find a solution moving forward.

U.S GDP Data – Totally Bogus

You can get in here and argue your case til the cows come home! – and I honestly hope that you do, as perhaps you’ve some insight / information that can better help me understand.

The U.S data released this morning is absolutely hilarious. Not just “kind of funny” but so absolutely outside the realm of believable that I’m literally “on the floor laughing”.

Let’s see what the markets make of both this “ridiculous GDP number” and the “magical drop” in unemployment.

I’ve only added to USD shorts as well watching Japan continue to slide with long JPY’s starting to take shape.

Short and sweet this morning, as I want to get “back to the circus” as soon as possible.

I’ve not had this much fun in a while!

USD will continue to be sold here.