Tagged: gold

Possible Hope For Gold

It’s been some long and grueling months for gold traders, and those watching PM’s and the miners in general. Week after week of potential bottoms or reversals – only to be followed by selling, selling and more selling. The price of both silver and gold in the “paper markets” passed the point of “rational” some months ago with seemingly no end in sight – a real tough spot for those holding strong…for sure.

We touched on this some weeks ago in that the problem with todays “investing environment” is that it “isn’t rational” – not in the slightest bit! With the amount of global stimulus being pumped into markets / Central Bank intervention etc – this isn’t in any way the market that most of you may be accustomed to investing in. Looking for similar results as one has experienced in the past has likely been recipe for disaster.

The fundamental reasons for owning gold have not changed, and likely grow stronger by the day as “paper money” planet wide is printed like toilet paper with hopes of keeping the ship sailing in the right direction just a little while longer.

How do you keep your sanity as a trader of Gold?

I would advise dropping your expectations. As simple as that.

I find it pretty unlikely that anyone is going to “time the trade” and make some massive “get rich quick” type thing any time soon with the purchase of Gold – however…..if one can lower their short-term expectations and try not to “treat it like a trade” – there’s plenty to made…….. if you can remain patient.

With the US dollar moving considerably lower over the next few months – this may be a decent time to start building positions – but in all…..we could just as easily see Gold consolidate here for months, and months on end. One needs to realize the Fed’s agenda and how a blatant rise in the price of Gold seriously undermines the goal of crushing USD – so as long as Ben’s got his finger on the printing presses – It’s hard to imagine gold getting too too far out of the gates.

Goldbugs – You Just Don’t Get It

I’m going to try and go easy – as I know many of the readers here are very much so invested in Gold. As well please keep in mind – I too believe in the long term story.

But with such macro forces at work – it absolutely pains me to envision you sitting there at home, considering every little tick up and down, gaps, bollinger bands, cycles, COT, and the most ridiculous of all – “selling on strength and buying on weakness numbers” – on “paper gold” through GLD!

It’s Ridiculous! Stop it! Stop it right now!

I’ve even heard some of you consider that Uncle Ben’s 85 billion dollars a month could in some way be “good” for gold prices?? Have you lost your mind? Seriously! It’s 100% completely the opposite!

Ask yourself this: Who on earth could believe the dollar’s exchange rate in relation to other currencies if the dollar was seen collapsing in value in relation to gold and silver?

This would completely defeat the money printing effort of the Fed – and completely undermine the bond buying!

The Fed is a private bank! with one goal and one goal only – to profit! They can’t possibly let the value of gold skyrocket if they intend to kill the U.S dollar! Think about it!

So……The Federal Reserve uses its dependent “wallstreet bank buddies” to short the precious metals markets. By selling naked shorts in the paper bullion market against the rising demand for physical possession, the Federal Reserve is then able to drive the price of gold down.

Bullion prices take a big hit, bullishness subsides and the flow of dollars into bullion is stopped….and the money printing can continue.

As long as the Fed continues to print ( and soon looks to print more ) I am at odds with any suggestion that gold will do anything more than trade flat at best.

In any case – bring it on then……I’m ready.

A Golden Hammer – Has Gold Bottomed?

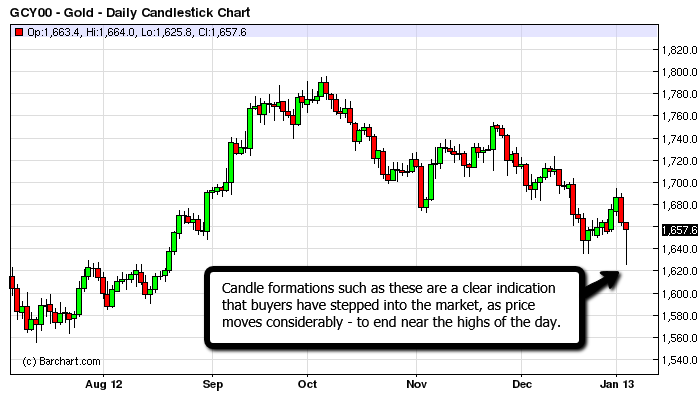

Hammer: Hammer candlesticks form when a security moves significantly lower after the open, but rallies to close well above the intraday low. The resulting candlestick looks like a square lollipop with a long stick. If this candlestick forms during a decline, then it is called a Hammer.

I’ll be the last one to call it as I am relatively new to the world of gold – but can tell you it’s been a complete and total grind for the past few months. This particular candlestick formation is usually a pretty good sign that buying interest has started to creep back in. Usually a trader will wait for an additional days candle to form (ideally closing above the high of the hammer) before entry.

If it provides any relief going into the weekend – I for one have considerable confidence that we should see some higher prices moving forward.

Gold Rinse Job – Cruel Irony

So I’m a fat cat on Wall Street – that’s just seen two straight days of retail investment pour into markets like liquid butta.

Can you get your head wrapped around the profits created (today alone) with respect to anyone who’d bought over the past two days and had a stop on their trade? Even a full 10% stop – completely annihilated!

As well for those newbies still trying to make a buck trading EUR/USD – because your broker offers teeny-weeny pip spreads and the ability to scalp / short-term trade. No shit! – any wonder why?

You have now been liquidated on your 2k starter account as EUR/USD dives a full 250 pips!

So….has anything changed? Is the Europe story on the mend? Has the world lost its interest in gold?

Nope.

Everything is exactly the same as it’s always been – as retail investment continues to fuel the engine of the massive steam roller smashing you to bits.

It’s a sad truth…………..It’s a cruel….cruel irony.

Mining – Could it Be In Our Genes?

Could the ancient astronaut theory hold true?

That thousands of years ago celestial vistors came to our planet in search of materials needed for their very survival – and in realizing the difficulties in extracting these materials from the ground, developed modern man to essentially do the hard work for them? When you really think about it…..it’s really not that far off.

As a young boy I remember a hoax that played out at my elementary school. A group of the older kids had painted a bunch of small rocks with gold model paint and hid them out in the sand of the school’s playground. Once the word got out….I recall the excitement and anticipation sitting there in my tiny desk, staring at the clock, squirming in my chair, waiting for the bell to ring. “Gold! Gold! – they’ve found gold in the playground!”.

We’d trip over ourselves racing out the door – eager to be the first to lay our hands on even the smallest spec of the glorious stuff. We spent hours on our hands and knees sifting, searching for our fortunes.

In the end…….I never found a single piece.

A silly young boy indeed – but is it really any different now as adults?

Maybe mining is in our genes.

An Absolutely “Golden Opportunity”.

Quietly……As “Hurricane Sandy” plots her assault on the Atlantic Coast of the United States – the dollar also plots its course for the 200 day moving average.

I´ve been watching patiently as the last winds of this “dollar rally” blow hard towards (the now flat) 200 day moving average….and now….only a few short gusts away – the storm has arrived!

Coupled with the recently announced “QE to Infinity” – one would have to assume this to be “certain death” to the dollar – and an absolute “Golden Opportunity” – to not only get short the buck – but to buy gold (and related stocks if that’s your thing) hand over fist!

I will be buying gold here (likely through the miners).

I will begin building several positions “short the U.S buck” as well Yen – against a basket of several currencies….as I look to “RISK ON” taking hold in coming days.