The Global Dow – Then And Now

It’s difficult for many to see what’s “going on globally” when all you’ve got day to day is “canned news” via the mainstream media. A casual glance at the T.V and it’s pretty easy to just assume “everything is up” – everything is moving along just fine.

The Global Dow – The Global Dow tracks leading companies from around the world in all industries. It covers both developed and emerging markets. In addition, it includes companies from emerging sectors, such as alternative energy. The components are equally weighted, which means that price movements of the larger stocks have no greater impact on index performance than those of the smaller stocks.

(GDOW) is a 150-stock index of corporations from around the world, created by Dow Jones & Company. Only blue-chip stocks are included in the index.

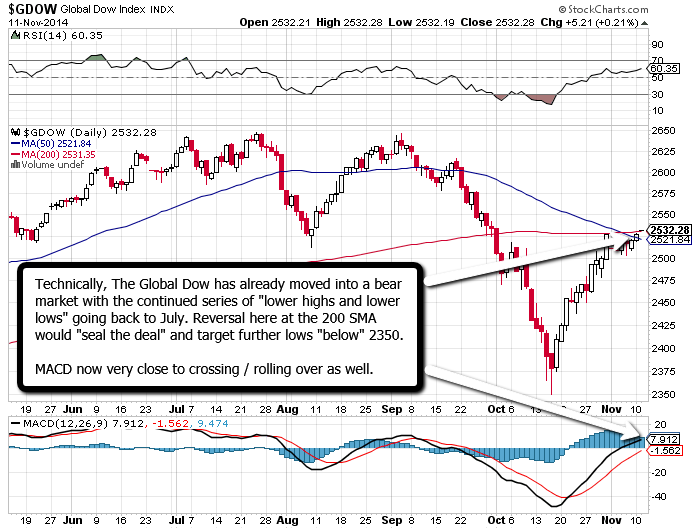

Lets take a look at the chart:

The Nikkei looks like a double top here…

View original post 135 more words

your arse is mine i bought a shitload of dec options on good old nikkei its is gonna blast for santa

LikeLike

You didn’t buy a single thing and you know it.

So your current “investment strategy” hinges on speculation that “Santa Claus is coming to town”?

That’s what I call brilliant. Absolutely brilliant.

LikeLike

Blown up again.

LikeLike

Hi Kong,

So, considering the action of the markets since Wednesday’s Fed, what’s your take now on global risk and market expectations?

We mentioned months ago that when the commodity currencies start to drop, so will risk. Since July, look what’s happened to AUD, NZD, CAD, as well as the commodity complex in general yet risk in terms of US stocks is merely a percent or so away from it’s all time high all on the back of even more QE/Easing coming from worlds CB’s.

With potential QE from Europe next year, irrespective of what Germany feels, this will be the final piece in the puzzle.

Am now waiting for US jobless to start to increase in the US on the back of the shale industry should Oil prices keeps tumbling, If this starts to happen, QE4 in US is just around the corner. Considering the generally poor macro data form US in general, can’t see any rate hikes next year in the US (let alone anywhere else in the world).

At present, all traditional models of valuation are kaput.

LikeLike